SEE More Profits!

Why you get more Cash Profits When Trading With Trade Credits

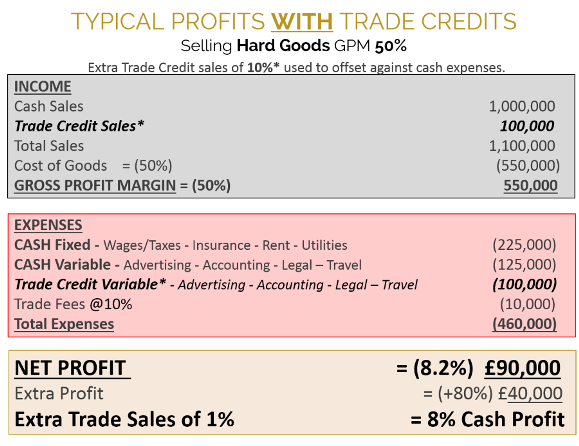

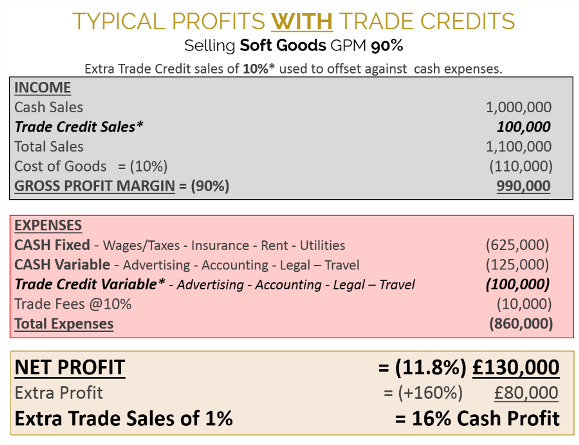

The Tables below show the increase in cash profits that a business can achieve by introducing an additional 10% growth through the use of Trade Credit sales to offset cash against expenditures.

Please Note:

There are primarily two classification sold through the exchange these are known as Soft and Hard Goods each have different trading characteristics which can be seen below.

SOFT GOODS

SOFT GOODS: CANNOT be sold twice or the next day and are usually sold on 100% Trade Credits at normal prices

Soft Goods such as: Hotel Rooms, Restaurants, Advertising, Professional Service, Rental / Hire Services, Excess / Surplus / Redundant Products, Travel Services.

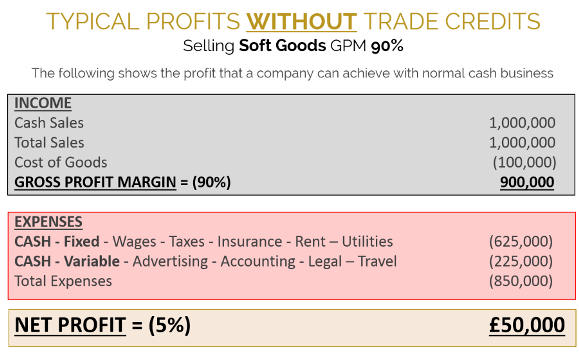

Selling Soft Goods

The Tables show the increase in profit that a business selling Soft Goods with a 90% Gross Profit Margin (10% Cost Of Goods Sold - COGS).

HARD GOODS

HARD GOODS: CAN be sold twice or the next day and are usually sold on a blend of PART CASH & PART Trade Credits at normal prices

Hard Goods such as: Vehicles, Computers, Machinery, Printing, Property, Electrical Goods, Equipment, Furniture, etc.

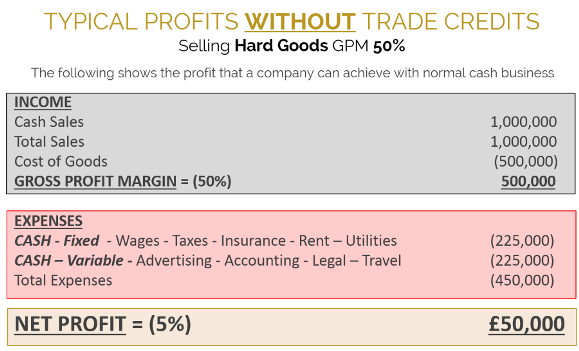

Selling Hard Goods

The Tables show the increase in profit that a business selling Hard Goods with a 50% Gross Profit Margin (50% Cost Of Goods Sold - COGS).

PROFITS WITH SOFT GOODS

CASH ONLY

WITH TRADE CREDITS

HARD GOODS

CASH ONLY

WITH TRADE CREDITS